| Average days to produce goods | 12 | days |

| Average days of inventory | 15 | days |

| Average days of accounts receivable | 50 | days |

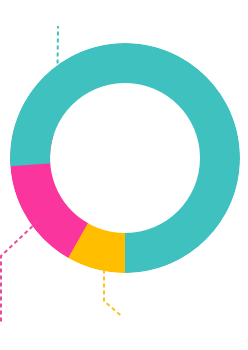

| Total operating cash cycle | 77 | days |

| Less: Average days carrying trade payables. | 30 | days |

| Net Operating Cash Cycle | 47 | days |

| # of Net Operating Cycles Annually | 7.8 | times |

Next Step >