For decades, junior credit officers have been taught the significance of the Five C’s of Credit. More importantly, they have seen how these play out while working through new loan originations, managing existing portfolios, negotiating the challenging terrain of workouts and periodically suffering the stress of loan losses throughout their careers.

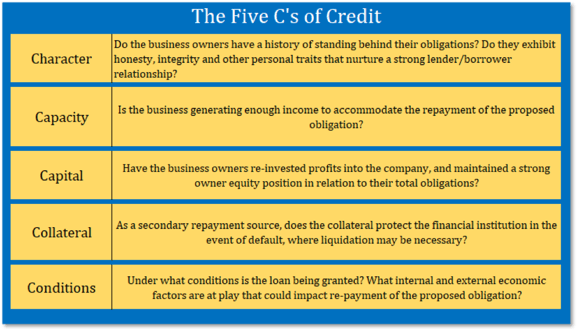

For those non-lenders reading this, the Five C’s of Credit include:

In todays’ lending environment, the Five C’s of Credit stand as a beacon for young lenders that have never managed a portfolio through a downturn.

Consider the number of lending and credit officers that began their careers during the last eleven years, after the Great Recession had begun its turn toward a long period of slow economic expansion.

Each of the 5 C’s of Credit has its moments. Collateral, Capacity and Capital weigh heavily during the pre-funding stage. Character certainly takes center stage whenever things don’t go as planned and the business owners must step up to ensure the loan continues to perform.

But for the COVID-19 world we’re in today, it’s Conditions that stands above them all.

As we entered 2020, few lenders could have predicted that by mid-April, more than 34 percent of the small businesses in the United States would be closed in response to a worldwide pandemic. No small business owners could have foreseen the drops in annual revenue that many have experienced this year, some greater than 50 percent year-to-date.

Even the most comprehensive stress testing would have fallen short when calculating the falloff in consumer spending that we witnessed in March, April and May. By June, many businesses were working their way back, only to be hit again by new business interruptions due to the spread of the virus in their state.

The events of 2020 have amplified the importance of both micro and macro economic conditions in the lending ecosystem. Even more so, they have revealed the critical need for lenders and borrowers to work together in anticipating future financing needs as those conditions change.

During the next 12 months, the small business community will be navigating a highly uncertain landscape. Actions such as the Paycheck Protection Program (PPP) helped millions of businesses during the first phase of the interruption, but now we’re in the long recovery phase.

Now it’s a question of how businesses can survive, and possibly thrive, in an economy that may be subject to abrupt starts and stops, periodic supply chain interruptions, volatility in consumer demand and more.

The result: at least for the short term, the nature of loan underwriting has shifted heavily toward Conditions on the ground when the loan is approved.

By mid-year the weight of 2019 balance sheets and income statements in the underwriting process had diminished in favor of short-term cash flow projections. Historical financial performance still served as a measure of company strength heading into the economic storm, but lenders needed to begin looking at shorter term measures of financial stability.

How much cash is on hand today? What does the sales forecast look like over the next four weeks? Can you secure enough inventory to meet current demand? What measures are being taken to keep your employees and customers safe? These assessments of short-term conditions now play a heavy role in new loan origination and active portfolio management.

Economic conditions have changed the trajectory of lending as well. The service sector of our economy took the initial brunt of the shutdown. These businesses include restaurants, hospitality, personal services and business service firms.

By nature, these are businesses that have relied heavily on SBA facilities such as the 7(a) and 504 loan programs. After PPP ran its course, the next wave of loan applications began to rise, and it was concentrated in the government guaranteed sector as well as in revolving working capital facilities. In a world where the average small business keeps less than 30 days of cash on hand, these markets needs are likely to continue well into 2021.

So Conditions, while often last on the list of Five C’s of Credit, is now critical to the process of business loan underwriting and risk ratings assessments. Credit availability in the current economic environment carries extra weight for businesses, as does the relationships forged between business owners and their financial institutions.

During the next 12 months, some businesses will continue to manage huge challenges while others will see significant opportunities. Community-centered financial institutions will be a critical player in both scenarios.

Stay up to date with the latest people-inspired innovation at Jack Henry.

.svg)

Learn more about people-inspired innovation at Jack Henry.

Who We Serve

What We Offer

Who We Are