My whole life, my mom has been taping money in my greeting cards. It was fun finding it; and typically, the larger denominations were handed in person. That is, until I moved. Now we live 500 miles apart. The first time I received a Benjamin taped down, I realized the pure unbridled sacrilege of it all. But money is money. No matter how old I get, a card is nice, and money from my grandparents warms the soul! But the Benji. I don’t want to rip him. He’s special. I wanted to scream, “Why are you taping it, Mom? It isn’t going to fall out of the sealed card!”

When Mom came to visit recently, she was disturbed that we couldn’t use the microwave. It was broken. How, you ask? Well, while cleaning, the oven mica sheet (which I referred to as the “cardboard heat thingy” until I had to research it for this blog post) was removed and it tore in half. After, I used the microwave anyway. Some of you are cringing now.

After Mom left, she decided to be my hero and send money for a new microwave. The moment of shock occurred when a text randomly popped up. My mom’s proper first name (she never uses) sent you money using Zelle®. This had to be a hoax. I immediately logged into my bank account and there it was with a message that read: “Get a microwave before my next visit.”

It was my mom! And officially, Hades had frozen over.

I had so many questions. Since my job is to be ingrained into the Zelle payments space through digital, I’m always curious why a person who I thought would go their lifetime taping money to a card would suddenly send money electronically. I immediately called to thank her (which is the proper thing to do, especially to the person who taught you that) while really wanting to find out how this miracle occurred. Mom has a limit of three questions before she starts yelling. You get that way when you’re raising kids on your own. I knew my questions had to be on-point to get the information I was looking for. Besides, she’s clueless what I do for work. She was a nurse and saved lives. I’m over here just trying to figure out faster payments.

Now, I know how important it is to build P2P in all channels. Many will just offer it in mobile, but Mom never would have found it there. It also might explain why Zelle is growing so rapidly – it’s attached inside digital banking and it’s instantaneous.

When we show Zelle embedded in our digital platform, the question always comes up: Why do I have to pay for this? Why can’t the customer/member just download the Zelle app and send money that way? That’s simple. My mom is not going to do all that. You have an entire generation that doesn’t use the mobile device as a primary device. A generation that cannot text or find a text. And many people in that generation are holding the deposits. They are the ones who will be sending money to their younger family members. This became very important when this generation could not leave their house during the pandemic. It’s either paste a Benji and hope it arrives a week later or send it in a trusted channel and loved ones receive it right away.

And remember, if you do offer P2P, consider allowing your limits to be large enough for accountholders to pay rent so they don’t seek out other electronic options. Or in Mom’s case, enough to pay for a microwave.

Another reason to avoid a downloadable app is the desire to keep the funds moving directly between banks and credit unions, without introducing a 3rd party. Downloading an app – whether it’s Venmo, Square, or something else – means the funds are moving between that 3rd party and another bank or credit union. Driving your accountholders to download apps can give fintechs the opportunity to try to steal them away. “But they are just P2P vendors,” you say. Not anymore. In March, Square announced FDIC charter approval to become a bank.

PayPal is the parent company of Venmo. When you are looking at social media and want to buy something, guess what payment type you are always offered? PayPal. It’s a trusted source. Lead your accountholders to Venmo and you’ve have led them to PayPal which now offers easy lines of credit that fit right in your mobile wallet and work almost anywhere an online purchase can be made.

My curiosity wasn’t completely satiated by interviewing Mom. Now I had to see it in action from a few perspectives on the send/receive front. I recruited my colleagues Bob and Cid while we were chatting one day. I will leave their last names off, so they don’t kill me at a conference later.

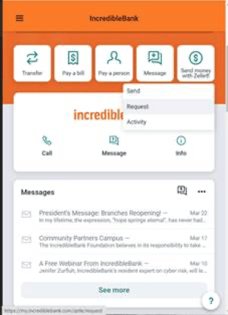

It began by me randomly saying, “Hey I just requested money from you.” This was accomplished by logging into my Incredible Bank App and clicking, “Send Money with Zelle” then “Request.” I added a message that if they want their presentations to go well, they will each send me $1.00.

During the request, I entered their work account emails. In both cases, Bob and Cid showed as “Recipient Must Enroll.” This is where you will want to pay attention if you offer, or plan to offer, Zelle.

Bob quickly exclaimed, “This is dumb! Why did I have to pick my bank and tell it where to go?” I responded, “Well, Bob … it doesn’t automatically know where to send it because I don’t key your receiving info in. You do.” In the meantime, Cid said, “I don’t have it at my credit union. Let me try the app.” This is referred to as “out-of-network” when the recipient does not have Zelle with their bank or credit union.

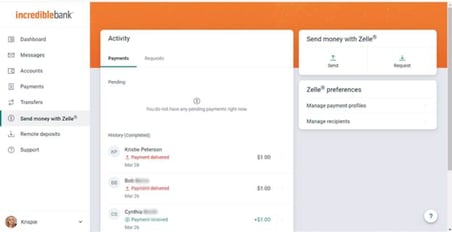

Bob then realized, “Oh. It’s because you sent it to my work email, but my personal email is attached to my bank account.” Cid followed up with, “Oh yeah, I’m using my personal email, too.” Once we figured this much out, they both enrolled their work emails and sent my requested blackmail funds. Their future presentations were safe.

Enrollment with a particular email or phone number is allowed only once. Zelle will recognize if a particular email address or phone number is already being used and will ask if its corresponding account information should be updated. But, you can also register multiple emails and phone numbers. A good rule of thumb is to encourage your end-users to ask the recipient where they prefer the request to go so that you don’t end up being tech support.

The funds cleared instantly. We all watched it hit our accounts back and forth. So fast and smooth, it makes your mouth drop. You can’t get that in an app-only experience with no bank or credit union involvement. Plus, users must then move the funds from the app to a bank or credit union account or open an account with that vendor to make it easier. Square sends a card when you enroll.

Here is a screenshot from online (or what Mom would call her Dell). This is a great place to view P2P history, which can also be a collections dashboard if requesting payments.

We can talk numbers, figures, and ROI, but thinking about the experience from a real person’s point of view can be extremely helpful. Because one thing the fintechs will never have over your Community Financial Institution is great service. Many have incredibly low service ratings because it’s nearly impossible to connect with a live human being.

When I first opened my Incredible Bank account (all online), I received an instant message from April at Incredible that my credit report was locked. I needed to unfreeze it and then call them to go through challenge questions. Oh man, now I had to talk to someone. But I unlocked my credit report and called. Someone answered on the second ring. I paused and said, “You’re not automated?” She replied, “I get that a lot.” I explained my issue, she looked me right up and walked me through fixing the issue. Without transferring me. Now I know they are incredible for real.

It’s up to your organization to be incredible - to differentiate yourself in this market by offering P2P in your online and mobile, and by giving great service. It will make your mom proud!

Stay up to date with the latest people-inspired innovation at Jack Henry.

.svg)

Learn more about people-inspired innovation at Jack Henry.

Who We Serve

What We Offer

Who We Are