A lot has changed since the confetti was cleaned off the streets when we entered 2020. There are real world health concerns, economic uncertainty, and fundamental changes associated with how we work, play and connect with others. We have also been introduced to a series of new terms including COVID-19, social distancing, global pandemic, and super-spreaders.

Many of us are adjusting to working remotely, caring for elderly parents while also helping young children with their schooling – the term “sandwich generation” has never been more appropriate.

As a financial institution (FI), there likely have been numerous changes to your lobby hours and employee schedules as we all adjust. However, we cannot “turtle up” and hide in our shell forever. We need human connections with family, friends, and business colleagues to maintain a healthy life.

For financial institutions in particular, 2020 has been challenging with economic changes, rate compression, increased credit risk, government stimulus, PPP (Paycheck Protection Program) loans, and forbearance rules that all impacted our operations.

For most institutions, 2020 will be a record year due to additional revenue sources (PPP and mortgage refinancing) along with record low charge-offs. These charge-offs are artificially low due to forbearance rules that don’t allow banks or credit unions to foreclose on delinquent borrowers during COVID.

While these forbearance rules seem appropriate, there will be a day of reckoning for the higher unemployment and increasing past due loans in the form of higher charge-offs once the stimulus and forbearance rules go back to normal. Most FIs are wisely choosing to take a portion of 2020 profits and re-direct them to enhancing loan loss reserves.

Against the bigger backdrop, let’s talk about a different challenge: In this socially distant world how do we connect and retain our best clients?

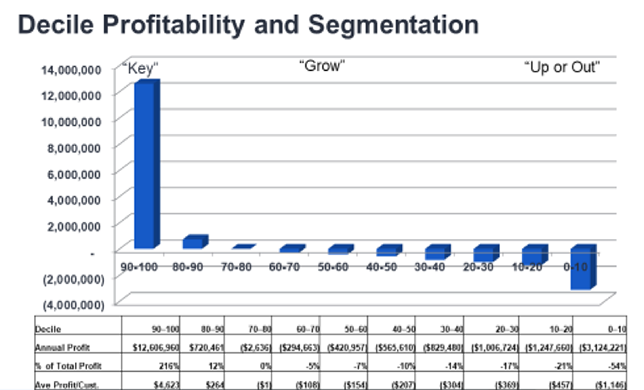

A client’s decile profitability is displayed below. Spoiler alert: It shows that over 180% of the profit comes from 20% of the clients.

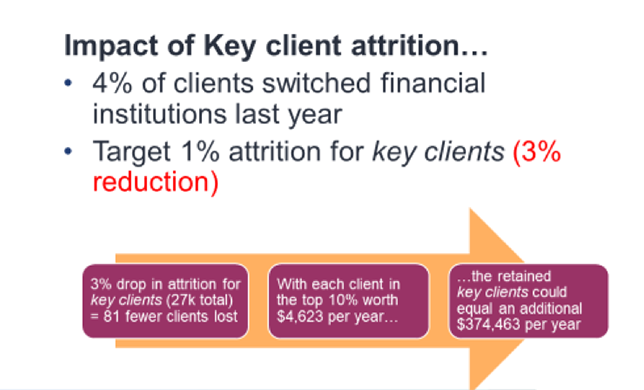

Retention of these top clients is essential. This high-performing community bank had an average profit of $4,621 for clients in the top decile. They had 27,000 customers (2700) in top decile. If 4% (108) of them were to leave, that would create a “headwind of attrition” of $499,068 (based on $4,621 in annual profit).

However, if we “connect” and retain all but one percent of those clients, we can reduce the “headwinds of attrition” by $374,463!

The second big step is around engagement and retention.

According to a 2020 survey by J.D. Power study on Customer Satisfaction in Retail Banking, the most satisfied customers use both physical branches and digital platforms. In this new COVID world with branches closed and hours restricted, we need to find different ways to engage.

Paul McAdam of J.D. Power states: “With fewer customers visiting branches, it will be important for retail banks to replace the in-person service they would have provided with personalized services delivered instead through digital channels.” I couldn’t agree more with McAdam.

Given client engagement is key to happiness and reduces attrition, we must connect with our clients in a meaningful way. I would propose:

While the ideal situation would be direct and personal contact with all your clients, your resources probably don’t allow for that. However, reaching out to those high-profitability clients, especially during these uncertain times, is key to success.

In these challenging times, financial institutions need to have a clear understanding of their clients and their profitability, then segment clients based on profit, and make meaningful connections to high-value clients.

Whatever you do, don’t turtle up!

Stay up to date with the latest people-inspired innovation at Jack Henry.

.svg)

Learn more about people-inspired innovation at Jack Henry.

Who We Serve

What We Offer

Who We Are